Statistics

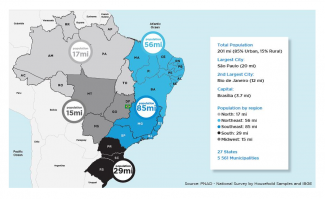

Brazil is the world's 5th largest country, with 204 million inhabitants and 8,515,767 km2 area. The latest data (2013) put per capita income at US$ 11,208.08 and GDP at US$ 2.246 trillion. Brazil's HDI ranking of 0.744 placed it 79th in the world. The country had a life expectancy of 73.62 years.

The 2013 data showed 105 million Brazilian Internet users, placing the country 5th in the roster of most connected countries. At that time, 52.5 million people were using mobile devices to access the Internet, but that number has risen to 68.4 million by 2015. According to Fecomércio-RJ/Ipsos, Internet-connected Brazilians rose from 27% in 2007 to 48% in 2011. The most frequently used places of access are LAN houses or Internet cafés (31%), followed by homes (27%) and relatives' or friends' homes (25%). In 2015, Brazil will be the world's 4th most connected country with 283.5 million cell phones (138.94 devices per 100 inhabitants).

Brazil’s 83 million Facebook users rank the country 3rd in the world. On YouTube, social media popularity with 9.75% of views earned it 2nd place, while 33.3 million users rank Brazil 3rd on Twitter.

Regions and their social and economic characteristics

Given its continental scale, almost all aspects analysed show that Brazil is very heterogeneous. The southeastern region, which contains the cities of Belo Horizonte, Rio de Janeiro and São Paulo, has the highest population density and economic output, as well as top levels of education and cultural facilities. The southern and northeastern regions are also standouts in terms of culture despite very different indicators for economics and education. The midwestern region has developed agriculture and cattle raising on a massive scale, while the northern region has the lowest population density, given the huge conservation areas in the Amazon basin. Regional demographic, social and economic numbers for 2013 are shown on top and below.

Public spending on culture and consumption of cultural goods

Public spending on culture and consumption of cultural goods

In Brazil, public investment in culture amounted to US$ 4.8 billion, which represents 0.2% of the total budgeted by the different levels of government. In 2011, the cultural sector production generated US$ 12.8 billion of added value, or 0.6% of total added value for the economy as a whole. The audiovisual sector accounted for US$ 8.6 billion, while the arts, music and concerts produced US$ 2.3 billion and books, US$ 1.6 billion.

In 2014, a Ministry of Culture quantitative survey titled “Sectoral Overview of the Brazilian Culture” revealed that many groups in society thought of culture as something that is “not for everyone.” This perception was shared by not only consumers but cultural agents and operators too. Brazilians see culture as something other than their usual sources of informative content or entertainment.

Based on 2013 data, this publication analyses the findings of an extensive quantitative survey based on a nationwide sample (74 municipalities with populations over 100,000) showing a 95% confidence interval and 2.4%, margin of error. Respondents came from classes A, B, C and D and were aged 16-75.

The study used the widely recognised concept posed by Pierre Bordieu that shows direct correspondence between consumption of arts and socio-cultural class. It also built on the work of Garcia Canclini, another scholar working on these lines who believes that cultural products should be appropriated just like any other commodities, although they are "goods that are used to think." In fact, cultural appropriation and consumption are as heterogeneous as the people involved, according to Bordieu and Garcia Canclini. Cultural policies should therefore obtain more detailed knowledge of audiences if they are to offer cultural products that will be consumed. This equation must factor in education, income and social environment. Hence, the need for a wide range of programs to cover the diversity of the population, offering events and products for the majorities thus identified.

Having the highest levels of quality of life, education and income, the Southeast also draws the highest investments in culture, generating a virtuous circle of consumption and investment for a population ready to appropriate the cultural production offered. In second place is the Northeast, with its strong tradition of folk and religious festivals.

For 67% of respondents, their cultural practice is associated with religious practice, followed by listening to music and enjoying outdoor activities. For 52%, cultural practice relates to folk or religious festive events. Reading, cinema and visiting exhibitions/museums and theatre accounted for 32%, 28% and 16% and 13% respectively. Most of these activities took place in the family environment, that is to say, in the company of parents or siblings.

Note that Brazilians consume cultural products mostly at home –listening to music, radio and watching TV and films. The survey shows that most frequent and well-liked cultural activity is listening to music at home. Outside homes, cinema, religion (or religious festive events) and pop music concerts, are the main activities nationwide, with minor percentage variations by geographical region, except for the Northeast, where the favorite leisure activities are related to religion, eating out and going to the cinema.

Another relevant figure is that 81% of cultural practices take place in the company of others. Activities carried out individually are visiting record stores selling CDs/DVDs, and public libraries. Cultural practices may therefore be described as gregarious activities that strengthen community ties.

Brazilians associate cultural practices primarily with leisure, or with pleasing others in their company, and thirdly to foster cultural growth, and perhaps intellectual growth too. There are also some using these practices as a way to escape from their everyday lives. This involves aspects of activities that provide entertainment, strong emotions, or just everyday practice. Innovation and content were important for only 4% in each case.

Continue reading Mapping Brazil - The Cultural Field: Sectors and Industries